Perspectives

The Deloitte Research Monthly Outlook and Perspectives

Issue 64

11 May 2021

Economy

Economic growth, inflation risks and COVID-19 variants: Asia's delicate balancing act

China's growth rate for Q1 of 2021 at 18.3% y-o-y came roughly in line with our expectation. We therefore see no reason to revise our 2021 GDP forecast of 7.5%. Exports remain the biggest driver of growth in the economy (CAGR of 13% from 2019-2021) while consumption continues to lag behind (CAGR of 4% from 2019-2021). The rest of 2021 is expected to stay more or less the same. However, the recent outbreak in India and renewed lockdowns in several European countries are likely to reinforce policymakers' cautions. As a result, Chinese tourists will stay in China, and in turn, the RMB will get a boost despite narrowing interest rate differentials between China and the US. We have moderated USD/CNY to 6.75 from 6.90. Such changes, therefore, reflect our analysis on the PBOC's calibrated approach of withdrawing liquidity against the backdrop of surging commodity prices (across the board) and asset inflation (mainly in real estate). Given the risk of inflation, the possible policy dilemma faced by some central banks and China's dominant role of generating demand for several economies, we would like to present our views on a 12-month horizon and in a regional context.

First, powerful stimulus policies and improving vaccine roll-outs in large economies are combining with enhanced economic resilience to produce a more formidable recovery from the pandemic-induced recession in the global economy than expected.

Second, downside risks that still need to be managed include the new spikes of COVID-19 infections, dangerous new variants of the virus and financial market turbulence if and when monetary stimulus is reduced and if imbalances such as inflation shake market confidence. We believe that carefully calibrated policies can help contain these risks.

Third, as confidence in economic recovery strengthens, the focus of businesses and markets will shift to the shape of the post-pandemic landscape and how various countries can “build back better” in the context of the opportunities and challenges that have emerged. The countries where governments carve out an appropriate role in supporting economic development and where the private sector adapts most effectively will be the ones that deliver superior long-term economic growth.

The region's recovery could well exceed expectations

A rapid upturn in the global economy is beginning to gather pace

China and South Korea are sizeable exporters, and thus, the demand for their exports offers a good reflection of the underlying dynamics in world trade. Trends in their exports show a stronger rebound in global demand than anticipated. The reasons for the surge in Chinese exports in March go beyond the low base in the first quarter of 2020 when the Chinese economy was suffering the worst impact of the COVID-19 pandemic. Comparing Chinese exports in March 2021 against those in March 2019, we find an expansion of about 21%. In fact, it looks as if global demand continued to firm up as April began – in the first ten days of April, South Korean exports were up almost by a quarter over the year ago. Another good portent is that South Korea’s export growth is broadening out beyond semiconductors to non-IT goods such as automobiles and chemicals.

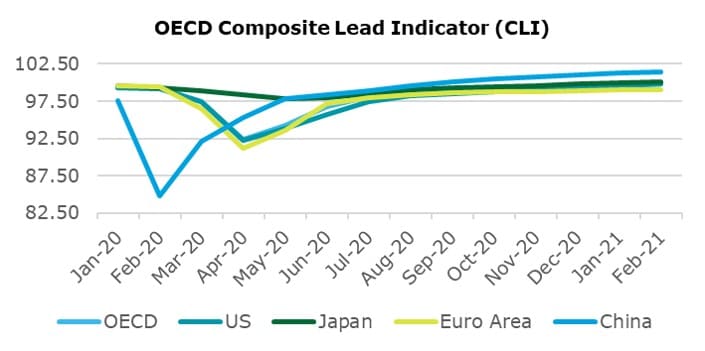

Chart: Global economy has been recovering rapidly

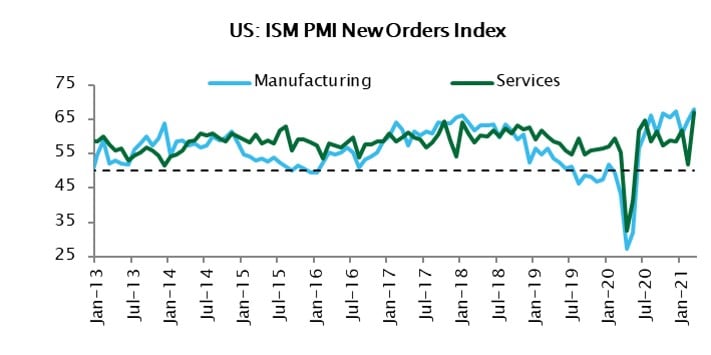

Moreover, there is evidence that this ongoing improvement in global demand is likely to be sustained. The OECD’s composite lead indicators have been a reliable predictor of future economic activity. The fact that they are improving across the board is thus a propitious sign. This is in line with surveys of purchasing managers which show the pipeline of new orders expanding. In March, the indicator for new business received by American companies in both the manufacturing and non-manufacturing sectors was close to the highest levels ever recorded. Taiwan’s new export orders are trending at their highest level in over a decade. Trends in the New York Fed’s Weekly Economic Indicator also suggest that second quarter economic growth in the US, still the single biggest engine of global demand, could accelerate rapidly.

The composition of trade is also congruent with the notion that the world economy is staging a substantial recovery. China’s imports in March were up a considerable 37% on the level in March 2019. Strong growth in Chinese demand should spur Asia-Pacific exports of commodities as well as components for electronics and related equipment, benefiting countries as varied as Japan, Australia, India and Indonesia. What this shows is that, as economies come to grips with the pandemic, economic recovery spurs growth in their imports. In that way, recovery in one country spills over into other countries and pulls them along as well. For instance, China's rebound is clearly the driving force behind the commodity boom which has broadened out.

The durability of the recovery will rest on several dynamics

Optimism about a formidable recovery may seem misplaced given the bad news on accelerating COVID-19 infections in India, Brazil and parts of Europe and the United States. Even more so when one considers the concerns over side effects which have plagued some of the new vaccines, slowing the roll-out of vaccines countries are depending on to bring an end to the pandemic.

Clearly, these threats to public health and a meaningful recovery should not be discounted. However, they need to be viewed within the context of other developments.

- First, economies appear to be developing greater resilience to new spikes in infections. Public health policy-makers, business leaders and ordinary consumers have adapted to the reality of the pandemic in ways that reduce the economic damage caused by these new waves of infections. Restrictions on activities in response to increased infections tend to be more targeted, so the drag on economic activity they cause tends to be less than before. Businesses have also been inventive in finding ways to minimise the hit to their operations – such as by selling their products or conducting business operations through virtual platforms. And, ordinary folk have also learnt to cope better with their fear of infections or restrictions on social mingling, finding ways to sustain their consumption habits through different means. This is one reason why activity in Europe seems to have held up better than expected during the early months of this year despite the bad news on more infections and lockdowns.

- Second, monetary and fiscal policies continue to provide considerable support to economies. Central banks in the large developed economies remain committed to a prolonged period of near-zero interest rates and high levels of quantitative easing. In the United States, the Biden Administration has followed up on its enormous USD1.9 trillion fiscal stimulus which is already being implemented with a USD2 trillion infrastructure plan that, if passed will be phased over eight years. This could in turn be followed by a further USD1 trillion package of social spending. These colossal amounts of spending will not only boost American economic growth this year and next but also spill over into other economies through trade spillovers.

- Third, the vaccination campaigns in large developed economies are gaining traction. At its current pace of vaccinations of roughly 3.1 million a day, the United States is on course to reach herd immunity by July. Europe’s vaccination programme has been roundly criticised for delays but recent weeks have seen a ramp-up. As a progressively higher proportion of people are vaccinated in the United States and Europe as well as in large developing countries such as China and India, governments will be more willing to normalise economic activity and consumers would feel sufficiently confident to use the huge amounts of savings to fund current consumption. Such release of pent-up demand should also be evident in corporate capital spending – and if that unfolds, then the rebound in economic growth would be ever so much more powerful.

These factors favour Asia-Pacific economies, with the tech cycle adding even more vigour to the recovery

The global electronics sector is in the midst of a structural upturn driven by the proliferation of 5G networks, rising semiconductor content in 5G-capable smartphones, and the maturation of marquee next-generation technology applications such as machine learning, artificial intelligence, and the industrial Internet-of-Things.

Indeed, the major chip foundries are putting in train capital spending programmes of unprecedented scale. TSMC plans capital expenditure of USD100bn over the next 3 years while SK Hynix’s USD106bn plan to build a new semiconductor fabrication complex housing 4 fabs producing next-generation memory chips has just been approved by the authorities.

The colossal scale of these recent investment commitments reflect the industry’s perceptions of future demand: a higher base-line level of semiconductor demand going forward, over and above the incremental demand from one-off factors such as the shift to work-from-home.

Asia is more exposed relative to other emerging economies to these favourable tailwinds. Several Asia-Pacific economies are highly geared into the tech cycle and will benefit hugely from these trends: Japan, South Korea, Taiwan, and Singapore are likely to be sizeable winners. Malaysia and Philippines will also benefit, albeit to a lesser extent.

Downside risks remain but can be contained by smart economic policies

There are any number of threats to the benign scenario described above but two in particular come to mind – the pandemic turning out to be worse than forecast and financial turbulence. In both cases, sound policy measures can alleviate the risks they pose.

New and more lethal waves of COVID-19 infections

After more than a year of dealing with the pandemic, the medical community is still discovering that there is a lot about it that they do not know. Because the virus mutates into variants such as the more infectious Brazilian and British variants, it has turned out to be a more persistent a threat than many observers had thought possible. Given the continuing and large-scale spread of the virus in populous countries such as India and Brazil, there is ample scope for even more variants to emerge, with one or more of them turning out to be much more lethal. It also turns out that in many societies, people have limited tolerance for the stringent limitations on social mingling that public health experts believe are needed to crush the virus.

The only way to mitigate this risk is through policy actions, several of which are falling into place:

- First, there should not be a premature withdrawal of monetary and fiscal measures to support spending. Then, even with the occasional spikes in infections which bring on restrictions on economic activity, the damage to jobs and incomes can be alleviated and the economy avoid a plunge. Indeed, policy signals from central bank meetings and other commentary by government officials suggest that Asia-Pacific policy makers are fully cognizant of the need for nuanced policy management.

- Second, it is vitally important to speed up and broaden vaccinations. The good news is that more and more countries accept that no one is safe until everyone is safe. As the richer countries become more confident that they can soon provide vaccinations for their populations, they will be more willing to underwrite vaccination campaigns in less developed countries. China and India have also been generous in supplying vaccines to poorer countries.

- Third, continued government support to expand research and development into vaccinations and medicines to treat the virus will help provide the range of medical responses that can help mitigate the threats to health that the virus might pose.

The experience of the past few months of infection spikes tells us that a combination of these policy responses can help mitigate these downside risks.

Financial market turbulence could be on the cards if inflation rears its head

If the global economy does indeed roar back to life ahead of expectations, then two risks to financial markets present themselves.

First, now-quiescent inflationary pressures could perk up, causing bond yields to rise and valuations of bonds, equities, real estate and start-ups look stretched.

Second, expectations could rise that the ultra-easy monetary policies we currently have might be withdrawn sooner than expected, causing abrupt dislocations in financial markets.

Indeed, as signs of economic recovery have grown in recent months, bond yields, equity prices and currency values have become more volatile, showing just how nervous financial investors have become that their expectations of a prolonged period of ultra-easy money might be upset.

Chart: Inflationary pressures could perk up

Our view is that inflation will rise but not to rates that will cause undue dislocation. However, there are other risks associated with the recovery that will pose a risk.

As economies come back to life while policies remain highly expansionary, there could be excess demand and excess liquidity. That has prompted fears in some quarters that there could be a sharp spike in inflation.

However, historical experience tells us that these excesses could be vented through three basic channels:

- Excess demand for domestic goods and services, which would produce higher inflation;

OR

- Through a surge in imports which could lead to current account deficits;

OR

- Into financial assets or real estate which could produce asset price inflation.

In other words, we should not focus only on the risk of a surge in inflation, excesses could be vented in other ways that raise the risk of (a) worsening external accounts or (b) overheated asset prices that could spook financial markets or which could force central banks and financial regulators to address through policy tightening which also upset financial markets.

Will inflation surprise so strongly on the upside in the coming year or two that we could see financial dislocations? We are sceptical about the likelihood of this for the following reasons.

First, even with a strong rebound, there will be sufficient slack in the global economy to limit pricing power – thus, even if commodity prices rise, these costs may not be fully passed on.

Second, inflation rarely accelerates sharply unless wage pressures become formidable. At current rates of job recovery, we believe that employment rates will not return to pre-pandemic levels until 2023.

Thus, the risks we anticipate are as follows:

- Inflation is likely to gather momentum in developed economies but remain below rates which would prompt an abrupt tightening in monetary policy. The major central banks such as the US Federal Reserve and the European Central Bank have emphasized that they will be wary of tightening policies. However, we do anticipate that financial markets will remain nervous and that there is a high chance of episodes of market turbulence due to bouts of market inflation fears in response to, say, occasional data releases which seem to show a rise in underlying inflationary pressures.

- With this strong recovery unevenly spread across the major economies and with the US economy surging in 2021-2022, there is a likelihood of the US current account deficit surprising on the upside. That could spur policy concerns in the US that could lead to more demands for protectionism in the US, which could in turn hurt Asian exporting nations. As the recent US Treasury report on “currency manipulation” showed, allegations of unfair management of Asian currencies could be used to justify trade measures against Asian exports.

So far, the PBOC has taken a more vigilant stance towards asset inflation (rising property prices in several major cities such as Shanghai and Shenzhen). Commercial banks are even scrutinizing sources of down payments in some cities. Indeed, central banks have a great responsibility to manage financial market expectations carefully so that movements in asset prices are not disorderly. Unlike most developed countries, China's asset inflation is also caused by a growing divide between south and north and rigid resident permit system. Therefore, in the short run, China has to rein in asset inflation in a more forceful manner, however, raising interest rates is not desirable when an already strong RMB weighs on industrial sector. On balance then, we see more administrative measures be rolled out to cool off the real estate market.

Financial Services

3rd Pillar of China’s pension finance to boom

The Ministry of Civil Affairs predicts that by the end of the 14th Five-Year Plan period China will have become a “moderately aging society”. Hence the 2021 Government Work Report mentioned "standardizing the development of the third pillar endowment retirement plan" as one of objectives for the future. This was further elaborated in the 14th Five-Year Plan (14th Plan), which aims to "develop a multi-level, multi-pillar endowment retirement plan system." With the successive introduction of reform measures in pension finance system, the "14th Plan" period will become an important window of opportunity for the development of commercial endowment retirement plans.

The “aging peak” is fast approaching

According to the United Nations, a country becomes an "aging society" when the proportion of the population aged 60 and above exceeds 10% or the population aged 65 and above exceeds 7%. When both proportions double, a country becomes an "aged society". Based on this standard, China became an aging society in 2000, and will become an aged society by 2025. The Ministry of Civil Affairs also estimates that during the "14th Plan" period, the population aged 60 and above in China will exceed 300 million, and the proportion of the population aged 65 and above will exceed 14%. Unlike developed countries, in China the aging of the population has preceded the accumulation of wealth. As a result, Chinese society is soon going to be faced with the multiple challenges of "getting old before getting rich", "getting old before getting ready" and a "rapidly aging" population.

Chart: The peak of aging population in China is coming soon

It is extremely urgent to develop the third pillar of pension finance

China’s pension system has ‘three pillars’: the state, enterprises, and private individuals. The state provides a basic old-age pension plan (the First Pillar), enterprises give their employees a (occupational) retirement annuity (the Second Pillar), and finally, individuals can also invest their savings in a pension savings assets system (the Third Pillar). However, the development of the three pillars is extremely unbalanced and cannot effectively meet the demands of the ‘retiring and retired’ population. Pillar I, the basic pension plan, has achieved its goal of "universal coverage". But Pillar II is not yet well established as some enterprises/employers still do not actively establish annuity plans to satisfy employees' pension savings demands. Pillar III was started in 2018 with the launch of the "Individual tax deferred commercial endowment retirement plan" pilot project, but as the coverage ratio remains very low, we cannot as yet tell how successful the pilot project has been. By the end of 2020, only 23 insurance companies had participated in the pilot and 19 have underwritten policies. The accumulated premium income so far has reached RMB 426 million and the number of covered people is only 48,800.

At the Pension Sub-Forum of the Boao Forum for Asia (BFA) on April 20, China’s Banking and Insurance Regulatory Commission (CBIRC) vice chairman Xiao Yuanqi directly addressed the issue of the extremely low proportion of Pillar III in China's retirement pension system, acknowledging that high household savings are parked in mostly short-term products without real pension characteristics. "The next step for regulators is to convert a large number of personal funds without pension characteristics into relatively secure, long-term third pillar financial products with pension characteristics and an assured level of returns.”

Individual funds will be transformed into 3rd Pillar pension products more rapidly

The Insurance Association of China (IAC) estimates that China will have a pension shortfall of RMB 8 trillion to 10 trillion in the next five to ten years. This will put pressure on the government and be a drag on the budget, if the other two pillars of the pension system are not developed in tandem. In mature markets such as the United States which have a higher degree of pension marketization management, and Japan which became an aging society much earlier, private pension funds such as Vanguard and Fidelity have played an important role in supporting the pension system and alleviating the pressure on the government of public pension payments. They also help in the development of the economy by channelizing present savings into future investment, thus making up for the long-term lack of funds in China’s financial system.

Since the "Two Sessions", regulators have repeatedly called for the transformation of individual funds into 3rd Pillar pension products, with the goal of improving the multi-level pension system as well as injecting long-term funds into China's financial system. The core of China's 3rd Pillar pension development is the link between commercial insurance products and the financial market, which requires the diversification and creation of innovative of pension-related financial products. Insurers, banks, mutual funds, trusts, asset management funds and other related financial institutions can be widely involved in this. Financial products such as bank wealth management products (WMPs), commercial endowment retirement plans and pension investment funds that meet the compliance requirements can all become Pillar III endowment retirement plan products.

Building the ecosystem for pension finance

Pension finance includes not only the pension system in a narrow sense, but also pension financial services and pension-based healthcare and wellness services. Thus, taken together, the sector is huge and financial institutions of all kinds have bright prospects. Through self-building or cross-sector cooperation, various financial institutions can provide comprehensive financial solutions for the elderly. For example, insurance companies can use their first-mover advantages to develop themselves as "end-to-end comprehensive service providers" for private endowment retirement plan products. Commercial banks can operate as advisers for "wealth + healthcare" with the full use of their strong risk control ability and good customer base. Fund/trust institutions can become managers of insurance or investment products. At present, PICC has been at the forefront of the transformation through its recently launched "insurance + service" products. It created "Yi Yuan" and "He Yuan" as two old-age care community brands as well as related medical care smart platforms through organic growth and acquisition. CPIC has implemented the build-up of a "health care ecosystem" and successively set up retirement communities such as "Wutong Family" in Shanghai and "Haitang Family" in Sanya. According to the Insurance Asset Management Association of China (IAMAC), so far 10 insurance institutions have invested in 47 retirement communities so far and private equity capital, invested in the upstream or downstream industries related to retirement/healthcare, has topped RMB 234 billion.

Implementing the strategy to actively cope with an aging population has been identified as one of the main tasks of the "14th Plan" period. It is the concrete implementation of the larger development goals of "continuously improving people's livelihood and well-being" and "ensuring a people-centered development philosophy". In the 14th Plan period, the development of a multi-pillar pension insurance system has been elevated to the height of national strategy, and the third pillar is at the very heart of this drive to compensate for the shortcomings of the other pillars. All kinds of financial institutions will need to be involved in the fulfilment of people's pension reserve demands, providing pension security, managing pension wealth, and acting as the "guardians" of people's pension money in order to promote the construction of an elder-friendly society.

Retail

Duty-free economy helps bring overseas consumption back onshore

This month marks the 10th anniversary of the Hainan offshore duty-free policy which was implemented on April 20, 2011. Data released by the Hainan Provincial Department of Commerce show that total sales of Hainan's offshore duty-free retail in the past 10 years reached nearly RMB 100 billion. In 2020, the Covid pandemic short-circuited China's outbound tourism, rendering it impossible for Chinese consumers to embark on overseas shopping excursions. Hainan therefore become an important channel for meeting Chinese consumers’ duty-free shopping demands. Data show that since the second half of last year, the number of duty-free business entities in the Hainan Islands has increased to 5, and the number of such stores has increased to 9. In the first quarter of 2021, average daily sales exceeded RMB 150 million per day. The strong headwinds of the last two years have fuelled the growth of the Chinese duty-free industry. According to China Duty Free, its revenue reached RMB 52.6 billion in 2020, an increase of 8.20% over 2019, while operating profit was RMB 9.7 billion, up 31.8% y-o-y.

It is worth noting that domestic duty-free retail is oriented towards outbound tourists and the purpose of boosting its development is to channel Chinese overseas consumption back onshore in a timely fashion. Therefore, duty-free shops and department stores are not in competition, they can co-exist. According to Yaok Group, global sales of luxury goods to Chinese consumers reached US $152.7 billion in 2019, accounting for one third of total global sales, 70% of which were from overseas shopping. China's duty-free market therefore makes it possible to channel this huge overseas consumption back into the home market. With travel becoming more difficult, China’s domestic duty-free market may see the following trends:

- In the short run, lack of offshore duty-free shopping opportunities will continue to drive the flow of overseas consumption back into domestic hands. According to Haikou Customs, in last year’s Golden Week, Hainan duty-free shopping reached RMB 1.04 billion, with 146,800 passengers and 998,900 items sold, up 148.7%, 43.9% and 97.2% respectively on a year-on-year basis. Meanwhile, in spite of regional travel restrictions during the Spring Festival 2021, the 7-day sales of duty-free shopping were over RMB 1.5 billion, the double of sales during the Spring Festival holiday before the outbreak of Covid-19 in 2019.

- The duty-free industry is accelerating the development of new business forms and models. Looking at the composition of China's duty-free market channels, the development level of border duty-free, airport duty-free and on-board duty-free introduced in the 1980s has been relatively mature in China. With the rapid development of retail digitization, China's duty-free industry has rapidly invested in online channels. During the pandemic, online sales programs such as online make-up purchases, daily direct shipping and Hong Kong online purchase were implemented, and online mini-programs have been successively launched in the form of order placing and offline pick-up or delivery. In addition to the online sales channels, the duty-free industry also began to make efforts in the private domain traffic pooling and membership reward system. For example, CDF launched a number of duty-free member purchase programs. At the same time, industry players such as Sunrise Duty-Free, Hainan Duty Free, CNSC and Shenzhen Duty Free have also developed its WeChat embedded mini-programs to capture private domain traffic.

- Nevertheless, the domestic duty-free economy still faces challenges. It has limited product categories and fewer new products when compared to overseas duty-free retail and therefore cannot fully meet the needs of consumers. So far, SKUs of domestic duty-free shop mainly focus on beauty and skin care, watches, bags and some luxury goods. If China’s duty free companies fail to cultivate inbound consumption habits, establish their own private domain traffic pools and enhance their membership reward systems during this period of international travel restrictions, duty-free consumers may still prefer overseas duty-free shopping once travel restrictions are lifted.

Logistics

Logistics industry must re-examine its strategy for high-quality development

SF Holding's unexpected loss highlights the development pain points of logistics companies

On April 8, 2021, SF Holdings announced that it expects a net loss of up to RMB1.1 billion for the first quarter of 2021. The company cited three key factors for this huge and unexpected loss.

1) Weakened profit expectations and increased subsidies. During this year's Spring Festival, SF introduced a special incentive payments valued RMB150 million to encourage staff to stay put to reduce cross-country travel and turnover. As a result, its operating costs climbed. Additionally, during last year's COVID-19 pandemic, SF's business volume increased rapidly, revealing a capacity choke points in its logistic transportation chain. The underlying issues forced SF Express to ramp up investment in infrastructure building.

2) SF Express faced a fierce price war. The e-commerce logistics industry is in an intense price competition. In Zhejiang Province, the price of a single parcel once reached as low as RMB1. In order to expand the e-commerce logistics business, SF Express also joined the price war in 2020. They priced the service at RMB5 per piece, but the cost of revenue is around RMB10. This resulted in a loss of the e-commerce logistics segment, which depresses the company’s overall profitability.

3) The company continues to invest in new business segments. In the past three years, SF's R&D expenditure has been rising every year. In the future, SF Express is expected to invest more in basic logistics equipment and engineering projects such as land, warehouses, sorting centers and vehicles. In addition, SF will continue to increase investment in R&D development for the IoT, smart warehousing, and drone delivery. For SF Express, increased capital expenditure is essential to providing a differentiated service in the industry. This, however, points to the general predicament of the current logistics companies, namely the price war dilemma derived from homogenization of services. The increased investment, instead, puts pressure on companies' profit. SF Express’ current loss represents the plight of the majority of logistics companies, which prompted logistics companies to start thinking about how to balance the capital expenditure and corporate profitability.

Logistics industry must re-examine its strategy for high-quality development

The gigantic losses incurred by SF holding has put a spotlight on the difficulties faced by logistics companies these days. In the present environment, it is essential that companies re-examine their business strategy from an operating perspective and not a sales one. In the face of continuous market expansion and intensified price wars within the logistics industry, companies need to pay more attention to the transport supply chain if they want to achieve economies of scale and thereby increase profitability.

- Operating efficiency for integrated warehouse and distribution service still needs to be improved

The first thing that must be addressed by companies looking to improve operating efficiency is warehousing and distribution services. The most significant issues here include the variability of warehousing service quality and the slow pace of digitalization within the industry. It is worth highlighting that only a very small number of companies today can provide customers with end-to-end transparency. The pace of digitalization is slow industry-wide, even though companies are aware that a digital logistics management system would greatly increase customer satisfaction. Furthermore, an online tracking system would also help companies keep minute-to-minute tabs on the logistics process so as to further improve the overall operational efficiency and achieve economies of scale.

- The shift to an e-commerce business model requires a more responsive supply chain

The rise of e-commerce necessitates the development of integrated warehousing and distribution services. However, as the sales model of e-commerce migrates from a ‘production determining sales’ model to a ‘sales determining production’ one, customers also demand a more responsive supply chain. There is still much to be done in terms of coordination between factories and logistics companies. As online sales become more important, logistics companies will have to upgrade the supply chain – paying special attention to order taking, transportation, and warehousing and distribution – in order to achieve their goal of improving service quality.

- The Development of Cross-border Logistics Requires Major Capital and Time Investment

According to the Chinese Customs, China's cross-border e-commerce imports and exports was worth about RMB 1.69 trillion in 2020, an increase of 31.1% over 2019. Cross-border e-commerce is becoming an important force in stabilizing foreign trade. However, cross-border logistics still face a series of challenges, namely GST policies and information exchange between different countries. The Chinese cross-border transport system still needs to introduce advanced cargo tracking technology, and speed up the information transmission process between ports, airlines, and transportation companies. Capital investment is essential to meet these needs. This again puts pressure on the ability of logistics companies to control costs and balance capital expenditure, which will remain a challenge for the industry as a whole in the future.

Energy

Decarbonization of power sector not simply ‘hype’

President Xi Jinping took part in the Leaders Summit on Climate hosted by U.S. president Joe Biden on April 22, 2021. During the virtual conference, President Biden vowed to put climate at the center of U.S. foreign policy and President Xi affirmed that China will strictly control coal-fired power generation projects, and limit the increase in coal consumption over the 14th Five-Year Plan period. This is a positive sign that cooperation between China and the U.S. on the climate issue is very much in the pipeline. The commitment by China’s top leader should go a long way in reassuring other countries as there still exists doubt about China's willingness to undertake power sector decarbonisation.

Decarbonisation potential of electric power sector

Several research institutions that work closely with the Chinese government have proposed pathways to carbon neutrality since the target was announced.

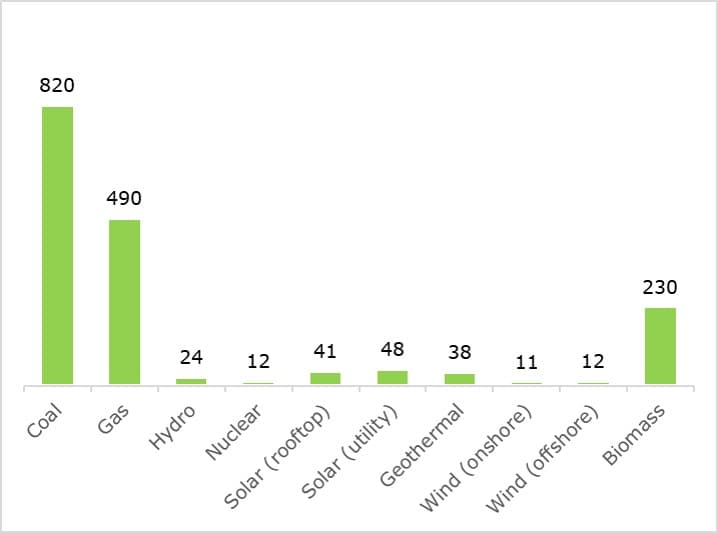

The proposals differ in details, but all agree that China should begin with power sector's decarbonisation by generating most of its electricity from clean sources, and expanding the use of clean power. It also will need carbon capture and storage facilities (CCS) to capture CO2 released from burning fossil fuels or biomass and store it underground.

For example, a scenario developed by Tsinghua University's Institute of Climate Change and Sustainable Development foresees a massive ramp-up of renewable electricity generation over the next 40 years, including a 16-fold increase in solar and a 9-fold increase in wind energy. Fossil fuels, including coal, oil and gas, would still account for 16% of energy consumed and, therefore, would need to be paired with CCS.

Another scenario developed by the Energy Research Institute of NDRC would see emissions peak as soon as 2022, at around 10 gigatonnes of CO2, followed by a steep drop to net zero by 2040. To achieve this, electricity production would double to 14,800 terawatt hours by 2050. It would be generated largely by nuclear power (28%), followed by wind (21%), solar (17%), hydropower (14%) and biomass (8%). Coal and gas would make up only 12% of electricity production.

Chart 1: Emission by Different Power Sources (ktCO2-eq/TWh)

SOEs are the first movers

Premier Li Keqiang in early March called for the formulation of specific plans to peak carbon emissions before 2030. SOEs are among the first to respond to the policy signals from the top. Five key electricity power generation companies have announced their carbon neutral targets.

Figure 2: Carbon targets of five key electric power generation companies.

Key trends to look out for

Clearly, just talking about carbon neutrality is not enough. Achieving the target will take decades and for it to happen, the following conditions must be met.

Define scope of commitment with global standards. Without a clearly defined scope of commitment, it's hard to understand and evaluate how companies intend to achieve their goals. Specialists use the Greenhouse Gas Protocol, a global standardised framework, to calculate and report corporate greenhouse gas emissions. The standards cover three different scopes:

- Scope 1: direct emissions from sources owned or controlled by the company;

- Scope 2: indirect emissions from purchased electricity;

- Scope 3: all indirect emissions in a company’s value chain, including the purchase of raw materials, business travel and product transportation.

Integrate energy storage to wind and solar at large scale. The ramp up of renewable energy will require the integration of economically viable and technologically sophisticated energy storage systems. In 2020, the year-on-year growth rate of energy storage projects reached 136% while the electrochemical energy storage system costs hit a new milestone of 1500 RMB/kWh. So far, local governments and power grid enterprises in 20 provinces have put forward “centralized renewable energy + energy storage” development incentive policies. We believe the strategic position of energy storage in the restructuring of China's power sector will be further clarified during the 14th Five-Year Plan period.

Promote the carbon trading market with operation details. China has launched its national carbon market. The Ministry of Ecology and Environment (MEE) released details of the "administrative measures for carbon emissions trading". This document aims to regulate the carbon trade and related activities within China. Next, MEE will formulate and publish regulatory documents on greenhouse gas accounting reports and verification, carbon emission rights registration, and transaction settlements.